OpenAI’s $500bn Stargate project drives record demand for high-bandwidth memory, benefiting SK Hynix and Samsung.

SK Hynix shares jumped about 10%, while Samsung Electronics climbed over 3% in Seoul trading Thursday.

Both companies secured roles supplying HBM for the supercomputer network, boosting investor confidence and market influence.

Samsung dominates global DRAM and NAND flash production, powering servers, smartphones, and cloud storage.

SK Hynix ranks second in DRAM and leads HBM supply for Nvidia’s AI processors.

Together, they control over half of the world’s memory market, shaping prices, capacity, and technology trends.

HBM Demand Rockets With Stargate Expansion

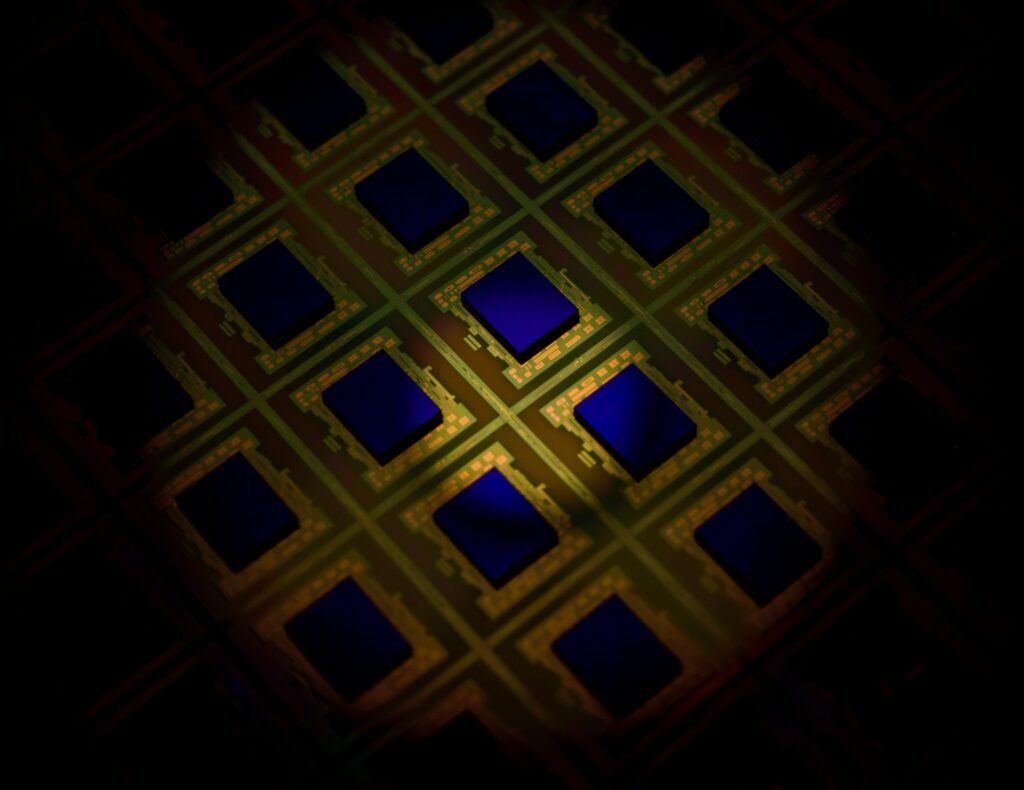

High-bandwidth memory enables AI chips to transfer massive data volumes at ultra-fast speeds.

Stargate will deploy AI supercomputers across continents, requiring hundreds of thousands of HBM wafers or stacks monthly.

Industry experts say this demand will shift global semiconductor capacity, reinforcing SK Hynix’s HBM3 dominance.

Samsung plans to expand its HBM4 production to meet OpenAI’s growing AI infrastructure needs.

The project triggers massive capital spending across the AI supply chain, benefiting chip manufacturers worldwide.

HBM’s role ensures high-speed AI processing, enabling the training and deployment of large-scale models.

Seoul Positions as Regional AI Powerhouse

Hosting Stargate strengthens South Korea’s ambition to become a regional AI and technology hub.

OpenAI and U.S. backers reinforce ties with Seoul while reducing reliance on China-sensitive supply chains.

Korea’s export-focused memory sector offers scale and political alignment, supporting U.S. strategic goals in AI development.

Seoul’s participation cements its role in next-generation AI infrastructure and global semiconductor influence.

The initiative demonstrates how strategic partnerships can combine technology leadership with geopolitical advantage.

South Korea now stands at the center of a major shift in AI hardware and memory production.